Quick Links

MDFIX is a unique fund of closed-end funds that seeks to capitalize on structural inefficiencies in the bond CEF market specifically, by making opportunistic investments in fixed income CEFs. Launched in 2020, MDFIX is our dynamic alpha proposition for the fixed income markets. Similar to our core offering, the strategy of MDFIX is to invest in bond CEFs that our team believes are materially mispriced (and where our team has a high conviction that the bond CEFs' discounts will close in the future).

Unlike most Multisector Bond funds, our Fund management team supplements using a traditional analytical framework on factors like duration and credit with a deep analysis of closed-end fund discounts to help us determine MDFIX’s allocations to the different fixed income categories (which we believe is a strength and differentiates us in the Multisector Bond category). As discounts move organically, we make decisions on when to sell out of a position and replace it with a more attractive opportunity. We believe that MDFIX is a responsive and opportunistic investment strategy that may offer a compelling complement to core bond allocations.

Investment Objective and Philosophy

The Matisse Discounted Bond CEF Strategy (MDFIX) seeks total return with an emphasis on providing current income.

Matisse Capital, the investment adviser to Matisse Funds, attempts to allocate the Fund’s assets among fixed-income CEFs that trade at significant discounts and pay regular periodic cash distributions.

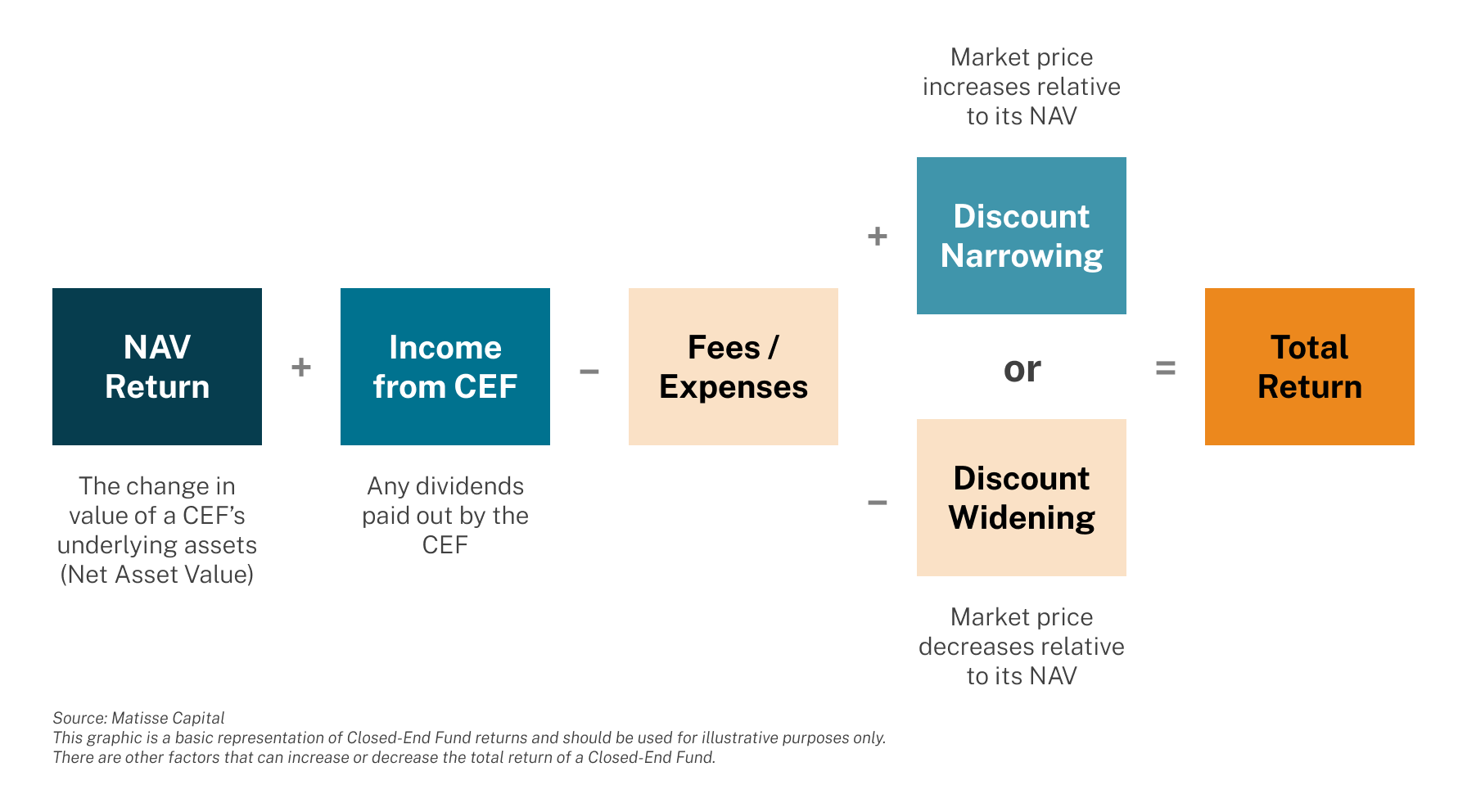

Matisse views CEFs as a unique opportunity where an investor can purchase a diversified fund that can potentially generate additional returns through a change in the relationship between a CEFs’ market price and its Net Asset Value (NAV)*.

*A CEF often trades at a price that is different from its NAV. A CEF’s market price can be less than its NAV, which means it trades at a discount. A CEF can also have a market price above its NAV, which means it trades at a premium.

Investment Strategy

- MDFIX is an open-end fund of funds that invests into discounted closed-end funds.

- We restrict the potential investment universe of MDFIX to CEFs that invest in fixed income securities.

- More specifically, we target fixed income CEFs that (1) trade at significant discounts to their NAV and (2) pay regular periodic cash distributions.

-

There are approximately 300 fixed income CEFs in existence (with a total market cap that is typically between $125.0 billion and $150.0 billion)

- These fixed income CEFs are spread out in different investment categories including high yield, municipal bond, foreign bond, bank loan, investment grade, and preferreds.

- Some of the largest issuers of fixed income CEFs include Nuveen, BlackRock, PIMCO, Legg Mason, and Invesco.

- Our Fund management team monitors all these CEFs in real-time using a proprietary quantitative model and builds a final investment portfolio of 30 to 90 fixed income CEFs that we believe are best positioned to experience future discount narrowing.

- We expect a majority of the Fund’s assets to be invested in investment grade bonds (bonds rated BBB or higher by Standard & Poor’s Rating Services or other equivalent by Moody’s Investor Service, Inc. or Fitch, Inc.).

- We primarily rely on our analysis of CEF discounts to help us determine MDFIX’s allocations to the different fixed income categories (high yield, municipal bond, foreign bond, bank loan, investment grade, and preferreds).

- As CEF discounts move organically, we make decisions on when to sell out of a position and replace it with a more attractive opportunity.

- Our Fund’s structure allows us to tactically shift our allocations among the different fixed income categories (if our analysis of discounts tells us to do so).

- We believe this is a strength and what makes MDFIX unique, and it gives MDFIX the potential to be a multi-strategy fixed income fund that can achieve good total returns.

Investment Rationale

- Limited capacity, value-oriented investment strategy focused on discounted bond CEFs.

- Pricing inefficiencies in the CEF market are largely driven by:

- Mechanics of CEF structure and trading.

- Behavioral factors relating to fear and greed (emotions of a retail-dominated investor base).

- Low institutional participation.

- Majority of players in CEF market are discount insensitive.

- "Flow-based" vs. "value-based" investment decisions.

- MDFIX seeks to take advantage of the strong mean reverting tendencies of bond CEF discounts.

- Open-end fund structure pays out anticipated monthly cash distributions to shareholders.

- Provides complementary fixed income exposure.

- Differentiated alpha proposition stemming from changes in bond CEF discounts / premiums to NAV.

Portfolio Management Team

Bryn Torkelson

Bryn is the founder and president of Matisse Capital, the adviser to Matisse Funds, and has 40 years of investment industry experience, including deep roots on the investment advisory side with institutional investors, family offices, foundations, and individuals. After more than a decade of work devoted to portfolio management and research in the closed-end fund space, Bryn launched the Matisse Discounted Closed-End Fund Strategy (MDCEX) in 2012 and serves as Co-Portfolio Manager. Bryn also serves as Co-Portfolio Manager of the Matisse Discounted Bond CEF Strategy (MDFIX), which was launched in 2020. Prior to founding Matisse Capital, he was senior vice president, managing partner, and perennial Chairman’s Club member at Dain Bosworth, Inc. (a former NYSE company), where he worked for 10 years. He started his investment career at Smith Barney Harris Upham in Seattle. He received a BS degree in finance from the University of Oregon in 1980.

Eric Boughton, CFA

Eric joined Matisse in 2006 and serves as the Co-Portfolio Manager and Chief Analyst for both MDCEX and MDFIX. Previously, Eric was a Portfolio Manager and Analyst with 1st Source, where he also co-managed a publicly traded mutual fund. Eric has worked extensively in the closed-end fund space, on both the research and portfolio management side, including discounted closed-end fund separate account management for Matisse advisory clients prior to the launch of MDCEX. Eric received a BS degree with distinction in mathematics from the University of Houston in 1997. He is a Registered Investment Advisor, and is a CFA charter holder.

Fund Information

Anticipated

Income Distributions

Monthly

Anticipated

Capital Gains Distributions

Annual

Fund Assets

Under Management

$49.9 Million as of 3/31/2024

Matisse Discounted Bond CEF Strategy Institutional CL

- NASDAQ Symbol: MDFIX

- CUSIP Number: 85521B833

- Load Type: No Sales Load

- Inception Date: 4/30/2020

- Minimum Initial Investment: $1,000

- Minimum Subsequent Investment: $100

- Redemption Fee: None

- Advisor Management Fee: 0.70%*

- Total Annual Fund Operating Expenses: 3.50%**

*The Advisor receives a monthly management fee equal to an annual rate of 0.70% of the Fund’s net assets.

**The Total Annual Fund Operating Expense for the Fund as disclosed in the prospectus is 3.50% dated August 1, 2023. The Net Operating Expense for the Fund is 3.22%. The Total Operating Expense is required to include expenses incurred indirectly by the Fund through its investments in closed-end funds and other investment companies. The Advisor has entered into an expense limitation agreement with the Fund under which it has agreed to waive or reduce its management fees and assume other expenses of the Fund in an amount that limits the Fund’s Total Annual Fund Operating Expenses (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions, (iii) acquired fund fees and expenses; (iv) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold short); (vi) taxes; and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor)) to not more than 0.99% of the average daily net assets of the Fund. This contractual arrangement is in effect through July 31, 2024, unless earlier terminated by the Board of Trustees of the Fund at any time. The Advisor cannot recoup from the Fund any amounts paid by the Advisor under the Expense Limitation Agreement.

Performance

Total Returns for Period Ending 3/31/24

| Performance as of 3/31/2024 | 3-Month | YTD | 1-Year | 3-Year | Since Inception MDFIX 4/30/2020 (average annual) |

|---|---|---|---|---|---|

| MDFIX | 4.32% | 4.32% | 13.65% | 1.78% | 8.67% |

| Bloomberg US Aggregate Bond Index | -0.78% | -0.78% | 1.70% | -2.46% | -2.15% |

| Bloomberg VLI High Yield Index | 1.27% | 1.27% | 10.99% | 1.80% | 5.41% |

| FT Taxable Fixed Income CEF Index | 6.57% | 6.57% | 17.83% | 1.00% | 8.19% |

The performance information quoted represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by calling 1-800-773-3863. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

| Yield as of 3/31/2024 | Distribution Rate | Subsidized 30-Day SEC Yield | Unsubsidized 30-Day SEC Yield |

|---|---|---|---|

| MDFIX | 7.06% | 5.24% | 4.98% |

Distribution Rate is calculated by annualizing actual distributions for the monthly period ended on the date shown and dividing by the net asset value on the last business day for the same period. Distributions may include capital gains distributions.

Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The Expense Limitation Agreement runs through July 31, 2024 and may be terminated by the Board of Trustees of the Fund at any time.

Bloomberg US Aggregate Bond Index: is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

Bloomberg VLI High Yield Index: a component of the US Corp High Yield Index that is designed to track a more liquid component of the USD-denominated, high yield, fixed-rate corporate bond market. The US High Yield VLI uses the same eligibility criteria as the US Corp High Yield Index, but includes only bonds that have a minimum amount outstanding of USD500mn and less than five years from issue date.

FT Taxable Fixed Income CEF Index: a capitalization weighted index designed to provide a broad representation of the taxable fixed income closed-end fund universe. The taxable fixed income closed-end fund market is comprised of the following sectors; high yield corporate, senior loan, global income, emerging market income, multi-sector, government, convertible, and mortgage funds.

The Total Annual Fund Operating Expense for the Fund as disclosed in the prospectus is 3.50% dated August 1, 2023. The Net Operating Expense for the Fund is 3.22%. The Total Operating Expense is required to include expenses incurred indirectly by the Fund through its investments in closed-end funds and other investment companies. The Advisor has entered into an expense limitation agreement with the Fund under which it has agreed to waive or reduce its management fees and assume other expenses of the Fund in an amount that limits the Fund’s Total Annual Fund Operating Expenses (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions, (iii) acquired fund fees and expenses; (iv) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold short); (vi) taxes; and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor)) to not more than 0.99% of the average daily net assets of the Fund. This contractual arrangement is in effect through July 31, 2024, unless earlier terminated by the Board of Trustees of the Fund at any time. The Advisor cannot recoup from the Fund any amounts paid by the Advisor under the Expense Limitation Agreement.

Category Ranking

Fund Category Ranking as of 3/31/2024

| Morningstar Category: Multisector Bond | Percentile Rank: Total Return 1-Year | Absolute Rank: Total Return 1-Year | Percentile Rank: Total Return 3-Year | Absolute Rank: Total Return 3-Year |

|---|---|---|---|---|

| MDFIX | 1st Percentile | 2nd out of 352 funds | 19th Percentile | 38th out of 315 funds |

This ranking was generated by Morningstar and includes all share classes for funds with multiple share classes. The performance used for this ranking information was based on total return, and some fees were waived during the period per the Advisor’s expense limitation agreement with the Fund. Absolute Rank measures the numeric rank of the Fund in its category when the category is sorted in descending order by total return (i.e. 1st would be the best performing fund in the category for the specified time period).

Portfolio Detail

As of 3/31/24

Asset Allocation

Fixed Income Allocation

Investment Process

Annual Fund Expenses

Understanding the fees you pay in a “fund of funds” can be confusing, and the SEC requires that the operating expense of MDFIX includes the operating expenses of its underlying holdings. The bottom line is that we cap our direct management fee on MDFIX at 0.70%, and the direct cash expense an investor pays is limited to a maximum of 0.99%.

Think our fund expenses look high? Before you jump to conclusions, learn more about why our expenses look high and see how each Fund’s Expense Limitation Agreement helps reduce the direct cash expenses paid by our shareholders.

| Expense | MDFIX | Expense Description |

|---|---|---|

| Advisor Management Fees | 0.70% | The Advisor (Matisse Capital) receives a monthly management fee equal to a maximum of 0.70% of the Fund’s net assets. |

| Distribution and/or Service (12b-1) Fees | None | Fees paid out of the Fund to cover the costs of distribution (marketing and selling shares of the Fund). The Fund has no fees related to distribution and/or service (12b-1). |

| Other Expenses | 0.57% | Expenses related to the operation of the Fund, including professional fees, administration fees, registration and filing expenses, Fund accounting fees, transfer agent fees, custody fees, shareholder fulfillment expenses, compliance fees, trustee fees and meeting expenses, miscellaneous expenses, security pricing fees, and insurance fees. The Advisor (Matisse Capital) does not collect any of these fees. |

| Interest Expense on Borrowings | 0.27% | Interest expense incurred by the Fund on amounts borrowed. The Advisor (Matisse Capital) does not collect any of these fees. Interest expense is charged directly to the Fund based upon actual amounts borrowed by the Fund. |

| Acquired Fund Fees and Expenses | 1.96% | The operating expenses of the Fund’s underlying investments in closed-end funds and other investment companies. These fees are not a cash expense of the Fund. The Advisor (Matisse Capital) does not collect any of these fees. Acquired Fund Fees and Expenses do not affect a Fund’s actual operating costs, and therefore are not included in the Fund’s financial statements, which provide a clearer picture of a Fund’s actual operating costs. The operating expenses in this fee table will not correlate to the expense ratio in the Fund’s financial statements, once available, because the financial statements include only the direct operating expenses incurred by the Fund. |

| Total Annual Fund Operating Expenses | 3.50% | The Fund’s costs as a percentage of the Fund’s total assets, before any fee waiver and/or expense limitation. The Total Annual Fund Operating Expense is required to include Acquired Fund Fees and Expenses. The Advisor (Matisse Capital) receives a monthly management fee equal to a maximum of 0.70% of the Fund’s net assets. |

| Less Fee Waiver and/or Expense Limitation | (0.28%) | The total amount of Advisor Management Fees, Distribution and/or Service (12b-1) Fees, and Other Expenses cannot exceed 0.99%, per the Fund’s Expense Limitation Agreement. These expenses are direct cash expenses to an investor in the Fund. Any fees above 0.99% are waived and credited back. |

| Net Annual Fund Operating Expenses | 3.22% | The Fund’s costs as a percentage of the Fund’s total assets, after any fee waiver and/or expense limitation. The Net Annual Fund Operating Expense is required to include Acquired Fund Fees and Expenses. The Advisor (Matisse Capital) receives a monthly management fee equal to a maximum of 0.70% of the Fund’s net assets. |

Understanding CEF Returns

Fact Sheets and Reports

Matisse Discounted Bond CEF Strategy Institutional CL

MDFIX

Prospectus and Applications

Matisse Discounted Bond CEF Strategy Institutional CL

MDFIX

To download any forms listed below, please click this link

- Summary Prospectus

- Prospectus

- Application

- SAI

- IRA Information

- IRA Application

- SEP IRA Instructions

- SEP IRA Application

- Cost Basis FAQ

- Cost Basis Election Form

Principal Risks of Investing in the Fund Disclosure

The loss of your money is a principal risk of investing in the Fund. Investments in the Fund are subject to investment risks, including the possible loss of some or the entire principal amount invested. The Fund is subject to certain risks, including the principal risks noted below, any of which may adversely affect the Fund’s net asset value per share (“NAV”), trading price, yield, total return, and ability to meet its investment objectives. An investment in the Fund is not a deposit or obligation of any bank, is not endorsed or guaranteed by any bank, and is not insured by the Federal Deposit Insurance Corporation or any other government agency. The following describes the risks the Fund bears directly or indirectly through investments in Closed-End Funds:

Closed-End Fund Risk. Closed-end funds involve investment risks different from those associated with other investment companies. First, the shares of closed-end funds frequently trade at a premium or discount relative to their NAV. When the Fund purchases shares of a closed-end fund at a discount to its NAV, there can be no assurance that the discount will decrease, and it is possible that the discount may increase and affect whether the Fund will a realize gain or loss on the investment. Second, many closed end funds use leverage, or borrowed money, to try to increase returns. Leverage is a speculative technique and its use by a closed-end fund entails greater risk and leads to a more volatile share price. If a closed-end fund uses leverage, increases and decreases in the value of its share price will be magnified. The closed-end fund will also have to pay interest or dividends on its leverage, reducing the closed-end fund’s return. Third, many closed-end funds have a policy of distributing a fixed percentage of net assets regardless of the fund’s actual interest income and capital gains. Consequently, distributions by a closed-end fund may include a return of capital, which would reduce the fund’s NAV and its earnings capacity. Finally, closed-end funds are allowed to invest in a greater amount of illiquid securities than open-end mutual funds. Investments in illiquid securities pose risks related to uncertainty in valuations, volatile market prices, and limitations on resale that may have an adverse effect on the ability of the fund to dispose of the securities promptly or at reasonable prices.

Fund of Funds Risk. The Fund is a “fund of funds.” The term “fund of funds” is typically used to describe investment companies, such as the Fund, whose principal investment strategy involves investing in other investment companies, including closed-end funds and money market mutual funds. Investments in other funds subject the Fund to additional operating and management fees and expenses. For instance, investors in the Fund will indirectly bear fees and expenses charged by the funds in which the Fund invests, in addition to the Fund’s direct fees and expenses. The Fund’s performance depends in part upon the performance of the funds’ investment advisor, the strategies and instruments used by the funds, and the Advisor’s ability to select funds and effectively allocate Fund assets among them.

Control of Closed-End Funds Risk. Although the Fund and the Advisor will evaluate regularly each Portfolio Fund to determine whether its investment program is consistent with the Fund’s investment objective, the Advisor will not have any control over the investments made by a Portfolio Fund. The investment advisor to each Portfolio Fund may change aspects of its investment strategies at any time. The Advisor will not have the ability to control or otherwise influence the composition of the investment portfolio of a Portfolio Fund.

Fixed Income Securities Risk. When the Portfolio Funds invest in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities. In general, the market price of fixed income securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities. Other risk factors include credit risk (the debtor may default), extension risk (an issuer may exercise its right to repay principal on a fixed rate obligation later than expected), and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). These risks could affect the value of a particular investment by the Fund, possibly causing the Fund’s share price and total return to be reduced and fluctuate more than other types of investments.

Credit Risk. There is a risk that issuers will not make payments on fixed income securities held by the Portfolio Funds, resulting in losses to the Fund. In addition, the credit quality of fixed income securities held by the Portfolio Funds may be lowered if an issuer’s financial condition changes. The issuer of a fixed income security may also default on its obligations.

Interest Rate Risk. Interest rate risk is the risk that fixed income prices overall will decline over short or even long periods of time due to rising interest rates. Securities with longer maturities and durations tend to be more sensitive to interest rates than securities with shorter maturities and durations. For example, (a) if interest rates go up by 1.0%, the price of a 4% coupon bond will decrease by approximately 1.0% for a bond with 1 year to maturity and approximately 4.4% for a bond with 5 years to maturity and (b) the price of a portfolio with a duration of 5 years would be expected to fall approximately 5.0% if interest rates rose by 1.0% and a portfolio with a duration of 2 years would be expected to fall approximately 2.0% if interest rates rose by 1.0%.

Junk Bond Risk. Lower-quality bonds, known as “high yield” or “junk” bonds, present greater risk than bonds of higher quality, including an increased risk of default. An economic downturn or period of rising interest rates could adversely affect the market for these bonds and reduce a Portfolio Fund’s ability to sell its bonds. The lack of a liquid market for these bonds could decrease the Fund’s share price.

Prepayment Risk. During periods of declining interest rates, prepayment of debt securities usually accelerates. Prepayment may shorten the effective maturities of these securities, reducing their yield and market value, and the Portfolio Funds may have to reinvest at a lower interest rate.

Derivatives Risk. The Fund may invest indirectly in derivatives through its investments in shares of the Portfolio Funds. The Portfolio Funds may use derivative instruments, which derive their value from the value of an underlying security, currency, or index. Derivative instruments involve risks different from direct investments in the underlying assets, including: imperfect correlation between the value of the derivative instrument and the underlying assets; risks of default by the other party to the derivative instrument; risks that the transactions may result in losses of all or in excess of any gain in the portfolio positions; and risks that the transactions may not be liquid.

Pandemic Risk. There is an ongoing global outbreak of COVID-19, which has spread to over 200 countries and territories, including the United States. The general uncertainty surrounding the dangers and impact of COVID-19 has created significant disruption in global supply chains and economic activity, increasing rates of unemployment and adversely impacting many industries. The outbreak could have a continued adverse impact on economic and market conditions and trigger a period of global economic slowdown. The outbreak of the COVID-19 pandemic has, at times, had, and is expected to continue to pose a risk of having, a material adverse impact on the Fund’s market price, NAV and portfolio liquidity among other factors. These impacts will likely continue to some extent as the outbreak persists and potentially even longer. The rapid development and fluidity of this situation precludes any prediction as to the ultimate adverse impact of COVID-19 on economic and market conditions, and, as a result, present material uncertainty and risk with respect to the Fund and the performance of its investments. COVID-19 and the current financial, economic and capital markets environment, and future developments in these and other areas present uncertainty and risk with respect to the Fund’s performance, portfolio liquidity, ability to pay distributions and make share repurchases.

Convertible Securities Risk. Convertible securities are hybrid securities that have characteristics of both fixed income and equity securities and are subject to risks associated with both fixed income and equity securities described below.

Cybersecurity Risk. As part of its business, the Advisor processes, stores, and transmits large amounts of electronic information, including information relating to the transactions of the Fund. The Advisor and the Fund are therefore susceptible to cybersecurity risk. Cybersecurity failures or breaches of the Fund or its service providers have the ability to cause disruptions and impact business operations, potentially resulting in financial losses, the inability of Fund shareholders to transact business, violations of applicable privacy and other laws, regulatory fines, penalties, and/or reputational damage. The Fund and its shareholders could be negatively impacted as a result.

Equity Securities Risk. Fluctuations in the value of equity securities held by the Portfolio Funds will cause the NAV of the Fund to fluctuate. Equity securities may decline in price if the issuer fails to make anticipated dividend payments. Common stock is subject to greater dividend risk than preferred stocks or debt instruments of the same issuer. In addition, equity securities have experienced significantly more volatility in returns than other asset classes.

Preferred Stock Risks. Generally, preferred stockholders have no voting rights with respect to the issuing company unless certain events occur. In addition, preferred stock will be subject to greater credit risk than debt instruments of an issuer and could be subject to interest rate risk like fixed income securities, as described below. An issuer’s board of directors is generally not under any obligation to pay a dividend (even if dividends have accrued) and may suspend payment of dividends on preferred stock at any time. There is also a risk that the issuer will default and fail to make scheduled dividend payments on the preferred stock held by the Portfolio Funds.

Foreign Securities Risk. The Fund may invest indirectly in foreign securities through its investments in shares of Portfolio Funds. Foreign securities involve investment risks different from those associated with domestic securities. Changes in foreign economies and political climates are more likely to affect the Fund than investments in domestic securities. The value of foreign currency denominated securities or foreign currency contracts is affected by the value of the local currency relative to the U.S. dollar. There may be less government supervision of foreign markets, resulting in non-uniform accounting practices and less publicly available information about issuers of foreign currency denominated securities. The value of foreign investments may be affected by changes in exchange control regulations, application of foreign tax laws (including withholding tax), changes in governmental administration or economic or monetary policy (in this country or abroad), or changed circumstances in dealings between nations. In addition, foreign brokerage commissions, custody fees, and other costs of investing in foreign securities are generally higher than in the United States. Investments in foreign issues could be affected by other factors not present in the United States, including expropriation, armed conflict, confiscatory taxation, and potential difficulties in enforcing contractual obligations.

General Investment Risks. All investments in securities and other financial instruments involve a risk of financial loss. No assurance can be given that the Fund’s investment program will be successful. Investors should carefully review the descriptions of the Fund’s investments and their risks described in this prospectus and the Fund’s Statement of Additional Information.

Investment Advisor Risk. The Advisor’s ability to choose suitable investments has a significant impact on the ability of the Fund to achieve its investment objectives. The portfolio managers’ experience is discussed in the section of this prospectus entitled “Management of the Funds – Investment Advisor.”

Quantitative Model Risk. Securities or other investments selected using quantitative methods may perform differently from the market as a whole. There can be no assurance that these methodologies will enable the Fund to achieve its objective.

Leverage Risk. Although the Fund will not itself employ leverage, the Portfolio Funds will often employ leverage, subject to investment company limits set forth by the U.S. Securities and Exchange Commission (the “SEC”). There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

Limited History of Operations Risk. The Fund is newly formed and has a limited history of operations for investors to evaluate. Investors bear the risk that the Fund may not grow to or maintain economically viable size, not be successful in implementing its investment strategy, and may not employ a successful investment strategy, any of which could result in the Fund being liquidated at any time without shareholder approval and/or at a time that may not be favorable for certain shareholders. Such a liquidation could have negative tax consequences for shareholders.

Loans Risk. Investments in loans may subject the Fund to heightened credit risks because loans may be highly leveraged and susceptible to the risks of interest deferral, default, and/or bankruptcy.

Management Style Risk. Different types of securities tend to shift into and out of favor with investors depending on market and economic conditions. The returns from the types of investments purchased by the Fund (e.g., closed-end funds which pay regular periodic cash distributions) may at times be better or worse than the returns from other types of funds. Each type of investment tends to go through cycles of performing better or worse than the market in general. The performance of the Fund may thus be better or worse than the performance of funds that focus on other types of investments, or that have a broader investment style.

Market Risk. Market risk refers to the possibility that the value of securities held by the Fund may decline due to daily fluctuations in the market. Market prices for securities change daily as a result of many factors, including developments affecting the condition of both individual companies and the market in general. The price of a security may even be affected by factors unrelated to the value or condition of its issuer, such as changes in interest rates, economic and political conditions, and general market conditions. The Fund’s performance per share will change daily in response to such factors.

Money Market Mutual Fund Risk. The Fund may invest in money market mutual funds in order to manage its cash component. An investment in a money market mutual fund is not insured or guaranteed by a Federal Deposit Insurance Corporation or any other government agency. Although such funds seek to preserve the value of the Fund’s investment at $1.00 per share, it is possible to lose money by investing in a money market mutual fund.